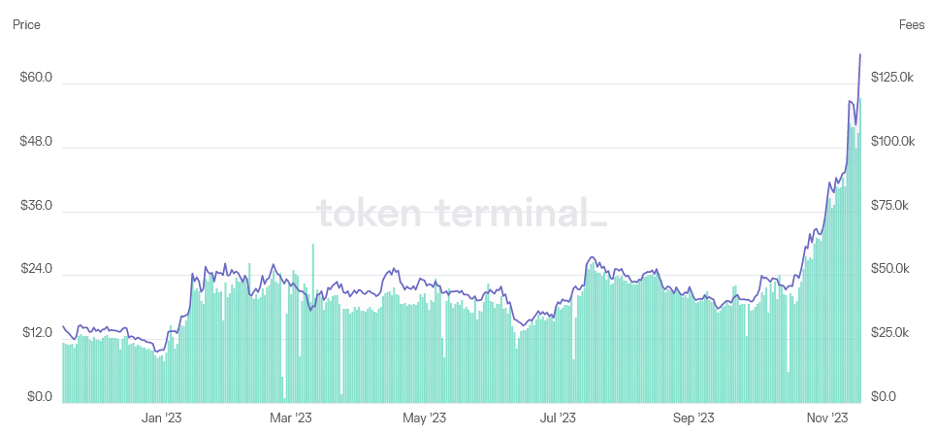

Crypto investors are buzzing about Solana again, and with good reason: the value of SOL is up over 350% since a year ago:

It has many of the hallmarks of a good investment: it’s a real project (a leading Layer 1), with real users (about 100K/day), generating real revenue (about $100K/day in fees).

But is it a good long-term investment?

At Bitcoin Market Journal, we’re in this for the long haul. And personally, I think Solana is a long shot in the long term. Here’s why.

There Can Be Only One (or Two)

Our first investing thesis is that while lots of experiments happen in the early stages of a new technology, ultimately only one (or sometimes two) big platforms survive in the long run. (Think PCs and Macs, Androids and iPhones, etc.)

In the traditional tech world, this is because big players get bigger, mostly through network effects: the bigger you get, the easier for new customers to join you. The smaller companies either get acquired, or driven out of business.

This is how we end up with Google gobbling up all the search business, OpenAI overtaking AI, and Salesforce forcing out other CRMs.

In the emergent world of blockchain technology, we are only just starting to understand what the categories even are. But one category is definitely smart contract platforms (a.k.a. Layer 1s), the operating system for crypto.

Ethereum (ETH) is, by all measures, the 800-pound gorilla in this space. They have the most users, the most revenue, the most developers. So for a competing Layer-1 like Solana, Ethereum is the one to beat.

For all the hype, let’s look at how Solana stacks up:

| Ethereum | Ethereum | |

| Daily Active Users | 300,000 | 100,000 |

| Daily Fees | $5M | $500K |

| Active Developers | 200 | 75 |

Source: Token Terminal (rounded for readability)

This is not to say that Solana must beat Ethereum in order to survive. Niche search engines like DuckDuckGo or WolframAlpha (I’m still waiting for WolframBeta) have survived against Google. But their market share is tiny by comparison.

As long-term investors, we don’t want to pick the projects that will survive; we want to pick the projects that will thrive. The numbers above show you that Solana has traction, but it still has a way to go.

It’s Not the Technology, It’s the Users

Blockchain nerds get really excited about Solana’s faster throughput (due to its Proof of History consensus algorithm vs. Ethereum’s Proof of Stake), and its developer friendliness (they can use languages like Rust and C, vs. having to learn Ethereum’s Solidity).

The tech crowd gets really excited about the tech, but no one else does. This is because the market does not really care about technology, the market cares about the users.

If a company is building a new blockchain application, where would they want to build it?

- The one with a better consensus algorithm, or the one where more users are going to be able to use it?

- The one with an easier programming language, or the one that’s going to generate more revenue and fees?

- The underdog, or the existing leader?

Companies will generally go with bigger tech platforms, because they’re a safer bet. There’s safety in numbers.

But what about investors? My experience is that investors also do not really care about the technology, they care about whether they can make money. The technology is only relevant if it’s going to lead to a higher price multiple in the end.

VHS vs. Betamax, MP3 vs. FLAC, QWERTY vs. any other keyboard layout: often the inferior technology wins. In blockchain, especially, the tech is only relevant if it leads to more users.

More users = more network effects = more value.

You want to find winning long-term investments? Look for blockchain projects with userbases that are large and growing. (Remember that before this recent price rally, the crypto outlets were bemoaning Solana’s drop in daily users.)

Where are the Killer Apps?

Layer 1s are like operating systems: to grab those critical users, you’ve got to have some killer apps. For example, VisiCalc put the Apple II on the map, AOL introduced the Internet to the masses, and Siri made the iPhone indispensable.

(In blockchain, we call them decentralized apps or “dapps,” but c’mon, they’re just apps.)

On Solana, you’ve got the usual assortment of dapps: a DEX (Serum), an AMM (Raydium), wallets (Phantom), borrowing/lending (Solend), NFT marketplaces (Magic Eden). I think of these as copycats of bigger, more popular dapps on Ethereum.

However, there are a few dapps that take advantage of Solana tech:

- The decentralized music platform Audius lets artists publish directly to listeners and cut out the middleman, using Solana’s higher throughput and lower transaction fees to handle a large volume of microtransactions.

- The MMO game Star Atlas runs a complex game economy with real-time transactions—all those tiny transactions are easier and faster to process on Solana than Ethereum.

- Mango Markets offers decentralized spot trading and perpetual futures, which is nothing new, but Solana’s speed and efficiency can allow for higher-frequency trading with lower latency.

So it’s possible that Solana can carve out a niche around dapps that require high-speed microtransactions. If that’s the case, we’d want to see a lot more of these specific dapps launching over the next year: dapps that you simply couldn’t build on Ethereum.

Investor Takeaway: So Long, Solana

The recent price gains are likely due to excitement over Solana’s Breakpoint community conference, and bullish sentiment from influencers like Cathie Wood.

But it’s unlikely that Solana will unseat Ethereum anytime soon. I don’t see any reason to jump on this bandwagon, especially when prices are triple what they were just a month ago.

But technology is full of surprises, and the early leaders aren’t always the later leaders. Ethereum may not be the Layer 1 for the long term, and Solana may carve out a profitable niche. But at the moment, ETH is still the one to beat.

So for now, it’s so long, Solana. But we’ll keep an eye on you.

For more tips on building wealth with bitcoin and crypto, subscribe to our daily Bitcoin Market Journal newsletter.

Leave A Comment