Price: [price_with_discount]

(as of [price_update_date] – Details)

[ad_1]

From the Publisher

What’s new in this second edition of Machine Learning for Algorithmic Trading?

This second edition adds a ton of examples that illustrate the ML4T workflow from universe selection, feature engineering and ML model development to strategy design and evaluation. A new chapter on strategy backtesting shows how to work with backtrader and Zipline, and a new appendix describes and tests over 100 different alpha factors.

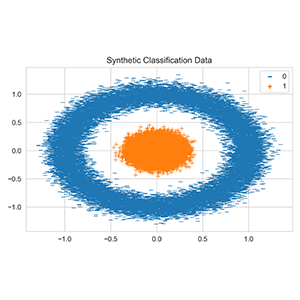

The book also replicates research recently published in top journals on topics such as extracting risk factors conditioned on stock characteristics with an autoencoder, creating synthetic training data using GANs, and applying a CNN to time series converted to image format to predict returns.

The strategies now target asset classes and trading scenarios beyond US equities at a daily frequency, like international stocks and ETFs or minute-frequency data for an intraday strategy. It also expands coverage of alternative data such as SEC filings to predict earnings surprises, satellite images to classify land use, or financial news to extract topics.

What are the key takeaways from your book?

Using machine learning for trading poses several unique challenges: first, fierce competition due to potentially high rewards in highly efficient market limits the predictive signal in historical market data. Therefore, data becomes the single most important ingredient for a predictive model and requires careful sourcing and handling. In addition, domain expertise is key to realizing the value contained in data through smart feature engineering while avoiding some of the pitfalls of using ML.

Furthermore, ML for trading requires a workflow that integrates predictive modeling with decision making. Many books on ML show how to make good predictions, but to succeed in trading we need to translate predictions into a profitable strategy of buying and selling assets. While we should always keep the ultimate use case of an ML application in mind during development, the opportunities and methodological challenges of backtesting are fairly unique to the trading domain.

How does Machine Learning for Algorithmic Trading differ from other algo trading books?

Compared to more generic ML books, not that many recent alternatives focus on both ML and trading. This book is perhaps the most comprehensive introduction because it covers both financial and ML fundamentals but also replicates recent research applications published by top hedge funds like AQR or at leading ML conferences like NeurIPS.

It is not only quite long with more than 800 pages, but also includes many resources for further study. There are over 150 notebooks that illustrate ML techniques from data sourcing and model development to strategy backtesting and evaluation. In addition, the book lists numerous references and resources so that readers can build on this material to build their own ML for trading practice.

Finally, it covers alternative data sources beyond market and fundamental data. There are three chapters on text data that show for example how to use SEC filings to predict earnings surprises with deep learning, and the book also covers working with image data.

Publisher : Packt Publishing; 2nd ed. edition (July 31, 2020)

Language : English

Paperback : 822 pages

ISBN-10 : 1839217715

ISBN-13 : 978-1839217715

Item Weight : 3.1 pounds

Dimensions : 9.25 x 7.52 x 1.69 inches

[ad_2]

Leave A Comment